Dear Republican Friends: Regarding Your Stand On Taxation…3

Posted In Activism,Blog,Favorites,Politics

by Sandor Stern

Dear Republican Friends,

Regarding Your Stand On Taxation…

Perhaps you can enlighten me because I just don’t get it. This nation is in a debt and deficit hole from which spending cuts alone cannot rescue us without doing irreparable damage to Medicare, Social Security, the military, and finally, to the entire economy. I know none of you earn $250,000 a year – you’re my friends, remember. You are part of the 99% of the population that earns less than $250,000 a year and yet you are willing to vote against a 4.9% tax increase on dollars above that income level. This is the same Clinton era tax level that wiped out the Reagan-G.H.W. Bush deficit of 1992 and ended with a surplus in 2000. So what’s the deal? Is it more than money?

Is it because you truly believe that taxing the top 1% is hurting the economy by penalizing the “job creators”? Remember we are not taxing business here. We are taxing the personal income generated from their own businesses by these “job creators.” Their personal income was given a tax break for Bush’s 8 years. According to the nonpartisan Tax Policy Center as of October 14, 2011 the Bush tax cuts had saved the top 1% of households over $700 billion and the next 4% of households more than $325 billion. The total tax savings for the top 5% totaled over $1 trillion. That’s money denied the federal government and extra money in the pockets of the “job creators.” So how many jobs were created in those Bush years? According to the Bureau Of Labor Statistics – 5.2 million jobs. According to that same bureau, Clinton’s 8 years of higher taxes created 23.1 million jobs. The irony, aside from the fact that higher taxes created more jobs, is that Bush’s job creation in the private sector was a loss of 563 thousand. More than 4.5 million jobs created during Bush’s years were government jobs. This from the party pushing smaller government and claiming that government does not create jobs. Since FDR’s term in office through all presidents up to January of 2011, the average private sector job creation under a Democratic President has been 1,463,220 and under a Republican President has been 642,000. You do the math. Because personal income is spent on personal needs and desires, perhaps the question of whether to lower taxes for the wealthy should be: is it better for the economy when one person buys a Bentley or 99 people buy Fords? Jobs are created through a demand for goods and services. That demand comes from personal income, which for 99% of workers is from wages. That’s not a trickle down economy. That’s a gushing up.

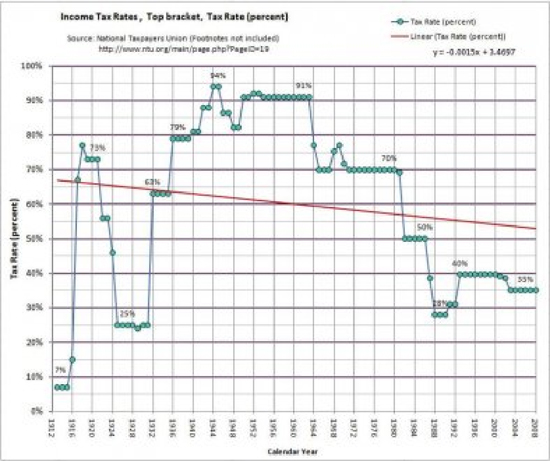

Is it because you have this notion that the government takes too big a bite out of your income? According to The Tax Policy Foundation the top marginal income tax rate in 1946 was 91%. The next 15 years “was one of the most successful eras in US economic history. The middle class boomed, the economy boomed, and the stock market boomed.” By 1965 the top rate had dropped to 70%. In 1982 Ronald Reagan dropped the top rate to 50%, in 1987 to 38.5%, and finally in 1988 he slashed it to 28%. The resulting federal deficit was so huge that GHW Bush had to break his campaign promise – “Read my lips: no new taxes” – and bump the margin up to 31%. For that he paid a huge political price from your party. But even Bush’s increased rate was not high enough to save the economy. Clinton arrived in 1992 and raised the top level to 39.6% and the economy boomed. Following his election, GW Bush lowered the top margin level to 35% and the economy went belly up. That Bush tax rate is still in effect and is lower than that of every other industrial nation in the world. So, in comparison to other countries and to our own history of higher tax margins, the bite does not square with your notion “big.” Nor does the bite square with the laments of the 1%. According to Who Rules America, in 2007 only 19% of income reported by the 13,480 individuals or families making over $10 million per year came from wages and salaries. So, a tax increase of 4.9% would only apply to one fifth of their total income. And remember, that bite is from taxable income not gross income. 80% of the income of these people is from capital gains and dividends which since 2003 have been taxed at a rate of 15% (lower than the income tax rate for a large percentage of middle class wage earners).

Is it because you believe that government spending is out of control? Based on a low tax rate it is. When in the history of the United States, or any country, has a war been fought without raising taxes to pay for it.? The costs of the Iraq and Afghanistan wars through 2011 was $1.26 trillion. How about compounding the problem by lowering taxes? Bush’s wars helped put us in this debt. Revoking the 1933 Glass-Steagall Act gave banks a free ride on depositor money and the housing market crashed. That banking and corporate bailout cost $1 trillion. Yes, it was Clinton who signed off on that bill, but it was passed and pushed by a Republican Congress. Yes, the debt is huge. Trying to erase it through spending cuts alone is like paying your way into heaven by selling your soul to the devil.

Is it because you believe in free enterprise? According to Who Rules America, the bottom 80% of the US population hold less than 10% of this nation’s financial wealth. In contrast, 1% of Americans hold a 42.7 % share. Since the election of Reagan in 1980 you have seen the rise of Corporate America and the demise of “mom and pop” America; the rise of monopolies and the demise of anti-trust laws; the rich getting ever richer and the workers struggling ever more to make ends meet. I know you belong in the 99%, so why this determined fight against your own interests?

Is it because you believe the persistent Republican cry that the Democrats will “tax and spend”? Do you prefer the Republican mantra of “borrow and spend” that began with the Reagan philosophy of “play now and pay later”? Anyone with a credit card knows the simple fact that borrowing money is renting money. The interest is rent and trillions of dollars will be paid by generations of tax payers to come. GW Bush handed the country a $455 billion deficit and a $10 trillion national debt. That’s over $32,000 owed by every citizen. You rant against increased taxes, but if that’s not a personal income tax hike what is? And FYI, that debt represents 3.2% of the nation’s gross domestic product – the second largest in history. The first was 6% set in 1983 after Reagan’s tax cuts.

Is it because Republican members of congress have signed a pledge to Grover Norquist to vote against tax increases under any circumstances? Do you not find this pledge a violation of their duties and obligations to uphold the constitution? What are Norquist’s bone fides that compel them to relinquish their free will? If a nation declared war on us and the President requested an increase in taxes to pay for the defense of this country, honoring Norquist’s pledge would be treasonous. Why is it not so now? Polls show that a large majority of Americans favor an increase in taxes on those earning over $250,000? Why are your Republican representatives going against a popular majority view? Is it because millions of dollars of campaign money is coming from corporations and billionaires who don’t want their taxes increased and who have the power to offer lucrative job opportunities to the congressmen who vote their way when they finish their terms in office?

Is it finally and ultimately because President Obama is anathema to the corporate power structure and for that reason the Republican goal for the past 3 1/2 years has been to limit him to a single term as President? Any reduction of the deficit that does not cripple Social Security and Medicare would be a win for Obama, and a loss of billions in profits for those corporations seeking to privatize pensions and health. Is that it?

Your inquisitive friend,

Sandy